How prominent earthquakes are in Washington State

Washington sits atop several dangerous seismic sources:

- Cascadia Subduction Zone: This offshore megathrust fault is capable of producing a magnitude ~9 “megathrust” earthquake. There is about a 37% chance of a significant (M7.1+) earthquake in the next 50 years, and roughly a 10% chance of a devastating magnitude 9–type event in that same span. The last full rupture was in 1700, but geological and historical evidence shows the region is overdue for a major event.

- Seattle Fault and other crustal faults: The Seattle area and Puget Sound region have their own active faults (like the Seattle Fault) capable of producing damaging earthquakes with much shorter recurrence intervals, making the risk in populous urban centers nontrivial.

- Overall regional risk: Multiple analyses and expert interviews (e.g., WSRB, Washington DNR guides) underscore that both the probability and potential impact—structural damage, liquefaction, secondary effects like landslides and tsunamis—make earthquake exposure a persistent hazard across much of western Washington.

Despite these risks, insurance uptake is low: recent reporting indicates only about 14% of homeowners west of the Cascades carry earthquake insurance, with even lower rates east of the mountains.

Why earthquake insurance matters

Standard homeowner or renter policies do not cover earthquake damage; earthquake coverage must be added separately or purchased as a distinct policy. Without it, a quake that damages or destroys a home can leave the owner to absorb rebuilding costs, contents replacement, and (if displaced) living expenses out of pocket.

Key features of earthquake insurance to understand:

- Deductibles are usually expressed as a percentage of the insured value (commonly 10%–20%), so for a $400,000 dwelling limit with a 10% deductible, the homeowner would be responsible for the first $40,000 of repair before the policy pays.

- Coverage components may include dwelling repair/replacement, personal property, loss of use (additional living expenses), and sometimes foundation or retrofit upgrades depending on the policy.

- Cost variability depends on location (proximity to faults), home age and construction, soil/liquefaction risk, and rebuild cost. National average figures put earthquake insurance premiums in the ballpark of several hundred to over a thousand dollars annually, but Washington’s high seismic risk drives pricing considerations; some local providers and specialty carriers (e.g., GeoVera) offer flexible limits and deductible options tailored for the state.

Risk management beyond insurance

Insurance is a financial backstop, but preparation reduces exposure and can lower loss magnitude:

- Seismic retrofitting (e.g., bracing cripple walls, bolting foundations) improves a structure’s survivability, though it doesn’t eliminate all damage.

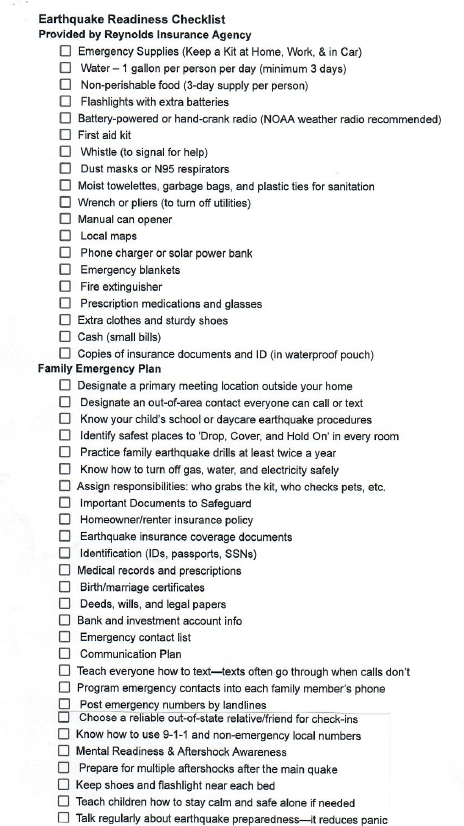

- Emergency planning and supplies—know evacuation routes (especially for tsunami-threat coastal zones), secure heavy items indoors, and have contingency funds—are critical because post-quake assistance may be delayed.

Weighing the decision

Given the combination of relatively high probability of impactful quakes, potentially catastrophic out-of-pocket rebuilding costs, and currently low insurance penetration, many homeowners and property owners in Washington—especially west of the Cascades and in urban centers like Seattle—should seriously evaluate earthquake insurance as part of a broader resilience plan. Factors to run through:

- Estimate your exposure (home value, fault proximity, soil conditions).

- Get replacement cost assessments to understand the deductible implications.

- Shop policies—compare carriers on limits, deductibles, waiting periods, and any bundled mitigation discounts.

- Combine with mitigations: retrofitting, emergency kits, and family/business continuity plans.

Summary recommendation

In a state where major seismic events are not a question of if but when, earthquake insurance converts uncertain catastrophic loss into a manageable financial exposure. Coupled with structural mitigation and readiness, it’s a critical piece of a layered risk strategy for Washington homeowners and businesses.